- The Ethereum platform was developed in 2015 by Vitalik Buterin

- After Bitcoin, Ethereum (ETH) is the most well-known and oldest cryptocurrency

- Following Bitcoin, Ethereum has the second-highest market capitalisation of all cryptocurrencies

- The Ethereum network is also referred to as a second-generation blockchain

- The Ethereum price chart reached its all-time high on 10 November 2021 with a value of 4,878.26 US dollars per ETH coin

About Ethereum

Vitalik Buterin, a prominent figure in the crypto world, created the Ethereum platform in 2014. His ambitions were grand; he intended to revolutionise the blockchain - the decentralised framework upon which cryptocurrencies are built. His vision was to build a platform for decentralised applications (DApps) that would be immune to surveillance, failure, and fraudulent activities. Unlike Bitcoin, Ethereum isn't only a cryptocurrency; it is a blockchain-based operating system that facilitates the creation of DApps. To put it simply, a blockchain is a database running, altering, and syncing simultaneously across a multitude of computers.One of the earliest tokens based on Ethereum's blockchain is the ERC-20 token.

The Ethereum project was financed through an Initial Coin Offering (ICO), a fundraising mechanism where investors receive tokens in return for their financial backing, enabling them to become part of the project from its inception. Currently, many cryptocurrency projects operate on the Ethereum network. 2022 saw the introduction of Ethereum 2.0, which initially caused a slight dip in the price. This upgrade involved a transition from the energy-consuming Proof of Work (PoW) mechanism, used to verify transactions, to the far more efficient Proof of Stake (PoS). Unlike the PoW mechanism that requires high-performance computations and substantial electricity, PoS demands significantly less energy.

Register now

Ethereum as a pre-mined cryptocurrency

Unlike Bitcoin, which relies on active computational processing of the blockchain (mining) and has a fixed maximum quantity, Ethereum falls under the umbrella of "pre-mined" cryptocurrencies. In this model, ETH coins or tokens were partially mined and disseminated before the official market launch, a typical occurrence when a project is funded via ICOs. Supporters and developers receive tokens upfront as a reward for their involvement in the project. Early supporters of the platform have reaped considerable profits due to Ethereum's price hike.

Unlike Bitcoin, the maximum quantity of Ether, or ETH coins, is theoretically limitless. However, a maximum limit, known as a "hard cap," may be set in the future. As it stands, approximately 122,000,000 ETH are in circulation.

Ethereum as the foundation for DApps and smart contracts

DApps are critical for the implementation of smart contracts. These contracts, due to their high level of automation, are easy to negotiate and enforce, finding potential applications in various sectors such as finance, real estate, and logistics. The idea is to accurately record the terms of a contract and upon fulfilment of the terms by one party, an automatic audit is triggered. Consequently, the smart contract is executed, precipitating an event such as a purchase or a service claim. Uniswap, a decentralised exchange allowing users to trade and swap Ethereum blockchain tokens without a middleman, is an example of a DApp on the Ethereum network.

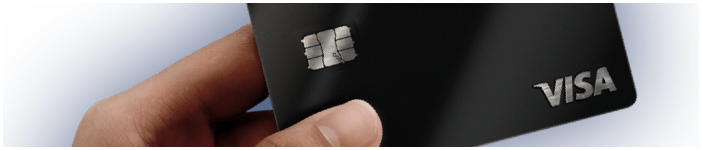

Ether as a means of payment

Ethereum tokens, like Bitcoins, can also serve as a payment medium. Numerous businesses accept Ethereum as a form of payment. Crypto credit cards such as the WealthBizzTradeFX Card enable investors to use digital assets for payment in stores. The assets deposited are converted at the current exchange rate into the respective fiat currency (like the US dollar or euro), which is then used for payment.

However, due to Ethereum's price volatility, ETH coins may not always be a reliable payment option. Investors can choose to endure a downward Ethereum price trend, hoping for a positive shift in their investment. Still, payments with Ethereum become significantly more costly during these periods. Those who rely on Ethereum for payments risk decreased purchasing power during downtrends in Ethereum's price.

Investing in Ethereum (ETH) and participating in the market

If you see Ethereum as a potential investment opportunity, WealthBizzTradeFX offers a straightforward and secure platform for cryptocurrency trading. To curb Ethereum’s price volatility, consider leveraging a WealthBizzTradeFX Savings Plan. This approach involves regular investments over time, availing the benefits of the cost-average effect. As a result, the cost of your Ethereum investment aligns with the average Ethereum price over time, considerably mitigating the impact of sharp price fluctuations.

Create your WealthBizzTradeFX savings plan today!

For those considering diversifying their crypto investments, WealthBizzTradeFX Crypto Indices present a compelling option. This feature enables you to purchase an assortment of cryptocurrencies simultaneously, diversifying your portfolio and distributing risk across multiple digital assets.

Start your journey with the WealthBizzTradeFX Crypto Indices

There are generally two routes to investing in Ethereum - direct and indirect. A direct investment involves the purchase of Ethereum coins or tokens, which are then stored in a digital wallet. Your wallet uses a public key to keep track of the blockchain address where your ETH coins reside. To receive cryptocurrencies, the public key suffices. However, for executing transactions, a private key serves as a security measure. Investors are strongly advised not to share their private keys, as it compromises wallet security.

Indirect investments, on the other hand, involve the purchase of financial instruments that mirror the Ethereum price movements. In this scenario, you don't actually buy and store ETH coins; instead, your funds go into Ethereum ETFs, ETNs, or CFDs. This method allows you to capitalise on Ethereum price trends without the need to set up and maintain a wallet yourself.

Important facts about Ethereum and Ether

- Vitalik Buterin developed Ethereum and published the Ethereum Whitepaper in 2014

- The platform is an advancement of blockchain technology

- After a hack of the DAO coin based on the Ethereum blockchain, the original blockchain split into the old Ethereum Classic and the corrected Ethereum blockchain (Hard Fork)

- The cryptocurrency Ether is based on the Ethereum blockchain

- Ethereum can be used to develop and utilise decentralised applications, or DApps

- The cryptocurrency is pre-mined and theoretically unlimited

- After the project was realised, the Ethereum price was 0.30 $ / ETH

- The all-time high for Ether was reached on 10 November 2021 with a value of 4,878.26 $ / ETH

- Besides the cryptocurrency Ether, the platform is mainly used for decentralised apps

- Due to the blockchain and high encryption, Ethereum is relatively safe from hacks

- ETH coins or tokens are stored in wallets

- Ethereum, unlike Bitcoin, is validated and thus also promoted by a Proof of Stake method instead of a roof of Work method

- The cryptocurrency consumed about 94 terawatt-hours of electricity per year before the introduction of Ethereum 2.0

- Ethereum 2.0 consumes 99% less energy thanks to the Proof of Stake mechanism than before the conversion of the blockchain

- The Ethereum blockchain is currently about 850 gigabytes large

Understanding the Ethereum price

The Ethereum price is dictated by the interplay of supply and demand. Since Ethereum operates as a decentralised currency, its price isn’t controlled by banks or states. A surge in demand drives the price upwards, whereas a decline in interest triggers a drop in price. Factors such as media coverage and political or economic developments can influence demand and, consequently, the price trajectory.

Ethereum Price: Key milestones and noteworthy events

The creation of the Ethereum platform was funded through an Initial Coin Offering (ICO). After the successful execution of the project, the Ethereum price hovered around 0.30 US dollars per ETH coin. Interestingly, the trajectory of Ethereum's price has largely mirrored that of Bitcoin. Ethereum achieved its all-time high, the peak price to date, on 10th November 2021, hitting a staggering 4,878.26 US dollars per Ethereum coin.

The most important milestones in the Ethereum price chart so far were:

- 2015: 0.42 $ / ETH

- January 2018: 1,420 $ / ETH

- December 2018: 81.19 $ / ETH

- 10 November 2021: 4,878.26 $ / ETH

- 2022: Low point of 880 $ / ETH

- 2023: Broke through the threshold of 1,500 $ / ETH

A glimpse at the Ethereum price history

Much like other cryptocurrencies, Ethereum's price trajectory indicates high volatility with significant price fluctuations. Since the inception of the project, Ethereum's price chart has generally trended upwards, albeit punctuated by occasional declines due to varying factors. Different experts forecast an upward trend for Ether in the upcoming years, largely driven by continuous enhancements to the versatile Ethereum blockchain and increasing interest from major corporations. However, it's crucial for investors to note that past price trends do not necessarily predict future performance.

Ethereum price amidst the crypto frenzy

Beginning in 2015, Ethereum experienced a gradual yet consistent price gain. Its price trajectory, akin to Bitcoin's, ascended with the increase in media attention. With the crypto frenzy in 2017, Ethereum's price soared rapidly. Speculations suggest that a market player used the cryptocurrency Tether (USDT) and the Bitfinex platform to artificially inflate Bitcoin's price. Ethereum, being blockchain-based, also attained its first all-time high in January 2018, reaching 1,420 US dollars per ETH coin. Following this hike, a period of extended correction ensued, leading to a dip in interest and subsequently, a drop in Ethereum's price to a low point of 81.19 US dollars per ETH coin.

The resurgence of cryptocurrencies

Over the next few years, cryptocurrencies gained traction as alternative forms of payment and asset classes. Large corporations and prominent figures poured substantial funds into various cryptocurrencies. Ethereum's price also profited from this uptick in the crypto market. On November 10, 2021, Ethereum hit its all-time high with a price of 4,878.26 US dollars per coin.

Global events and regulations impacting Ethereum price

In 2022, several nations worldwide expressed intentions to regulate cryptocurrencies. China banned cryptocurrencies outright, and India contemplated banning private crypto wallets towards the end of 2021. With the start of the war in Ukraine coupled with rampant inflation, Ethereum witnessed a decline in price. The collapse of the crypto platform FTX and the Terra blockchain also stirred increasing unease among investors, causing Ethereum's price to plummet to a low of 880 US dollars per token. However, in the ensuing months, Ethereum registered consistent price gains, reaching a price point of 1,600 US dollars per ETH.

Ethereum 2.0 and future price projections

With the successful transition to Ethereum 2.0 in 2022, also known as "The Merge" due to the integration of two Ethereum blockchains, the Ethereum price initially took a significant hit. Experts tie this price trend to investors' apprehension over potential stricter regulation of the cryptocurrency. US authorities suggested that Ethereum 2.0, being a Proof of Stake cryptocurrency, might be classified as a security, which could warrant rigorous oversight. Consequently, the price initially dipped to below 1,300 US dollars per Ether.

By 2023, however, the ETH price had rebounded and surpassed the 1,500 US dollars per token mark. Experts anticipate a substantial value hike for Ethereum in the coming years. This optimism is largely fueled by the overall crypto enthusiasm, receding inflation, and the stabilisation of the geopolitical landscape.

While Ethereum has seen significant price gains since its market introduction, it's vital to remember that past price trends aren't necessarily indicative of future value developments.

Ethereum: Factors influencing the price

Ethereum holds the second-highest market capitalization among all cryptocurrencies, second only to Bitcoin, currently around 200 billion US dollars. This goes to show the currency's robust standing in the crypto market. Many factors can sway Ethereum's price, thereby affecting its market capitalisation.

Ethereum price amid political and economic developments

Historically, Ethereum's price trajectory has shown strong correlation with geopolitical incidents, market economic trends, and political decisions. Events like the Ukraine war, surging inflation, and political discussions concerning the regulation of cryptocurrencies could trigger considerable price drops. Nevertheless, Ethereum has typically managed to offset these losses over the long haul. Therefore, Ethereum's value has multiplied significantly since 2015. However, it's critical to note that past prices cannot guarantee future developments.

Inflation and triple halving

Unlike Bitcoin, there isn't a fixed upper limit on the possible number of Ethereum coins. The launch of Ethereum 2.0 didn't coincide with a classic halving event, where the mining reward is halved roughly every four years. Instead, the issuance of new ETH coins through mining was drastically curtailed. Since this effect mirrors that of three Bitcoin halvings, experts often refer to it as a triple halving. This process significantly curbs Ethereum’s inflation.

Ethereum as a payment method

Given its sometimes significant volatility, Ethereum's use as a payment method is somewhat limited. Its adoption is not yet widespread, with only a handful of companies currently accepting payments in Ethereum and other cryptocurrencies. Predominantly, investments in the cryptocurrency prove beneficial as an asset. Investors can anticipate long-term gains given the generally ascending prices and projected price trends. However, it's important to note that the value can also plummet sharply in the interim, causing a substantial decrease in purchasing power during such phases.

Security and market manipulation

Due to its blockchain foundations, cryptocurrencies like Ethereum provide a high level of security. Fraudulent schemes and cyberattacks usually target the exchanges, wallets, and personal data of individual investors. To enhance the security of their assets, investors can stay informed about the current tactics employed by scammers to ensure protection. Moreover, private access data should never be shared with unknown parties. The most secure storage options for personal keys are called ‘cold wallets’. In this scenario, the access data and addresses are stored on an offline medium, providing protection from unauthorised access.

Another risk element is market manipulation. For instance, it is speculated that the crypto boom of 2017 was the result of deliberate market manipulation by certain interest groups. Given its established status and substantial market capitalisation, the risk of "pump-and-dump" manipulations of Ethereum's price is lower compared to other cryptocurrencies.

"Pump-and-dump" refers to a strategy wherein a cryptocurrency is purchased, its price is artificially inflated through market manipulation, and then the coins are sold off at a profit.

Commodities* Invest in commodities 24/7

Commodities* Invest in commodities 24/7 BITCOIN What to know when you are just starting to invest

BITCOIN What to know when you are just starting to invest ASSET MANAGEMENT Your investment, your assets: Why your money is safe with WealthBizzTradeFX

ASSET MANAGEMENT Your investment, your assets: Why your money is safe with WealthBizzTradeFX COUNTDOWNBitcoin Halving Countdown 2024

COUNTDOWNBitcoin Halving Countdown 2024 ACADEMYWhat is the Bitcoin halving?

ACADEMYWhat is the Bitcoin halving?